1 Monster Stock Opportunity In the Global Chip Shortage

It doesn't take much looking around to see the digital transformation the world is to undergoing. Smartphones are glued to people's hands, electric cars are increasingly appearing, and there's no shortage of gadgets to "smartify" homes. Even wilder is that much of this has happened in the past couple of decades.

Behind many of these electronics that now seem inescapable are semiconductor chips, which power them. Unfortunately, shortage issues started during the COVID-19 pandemic, and have continued. Despite these challenges, investors with a longer timeframe can invest in one of tech's most important businesses: Taiwan Semiconductor Manufacturing Company (NYSE: TSM), or TSMC.

Your favorite tech company's favorite chip supplier

Part of what established TSMC as the global chip leader is the foundry model it pioneered. TSMC doesn't make chips that people or companies can buy online or at a retail store like typical electronics. Instead, the company makes chips designed for other companies' specific needs. It's like ordering custom-tailored clothing instead of buying something off the rack.

Many global leaders depend on TSMC's chips for their operations. Apple uses it for its iPhones, Nvidia uses it for its graphic processing units (GPUs), and Sony uses it for its game consoles. Being able to handle customers' demands on a large scale has given TSMC a competitive advantage because its chips are industry-leading, and it's not easy for companies to switch between chip manufacturers.

Check out TSMC's key financial growth

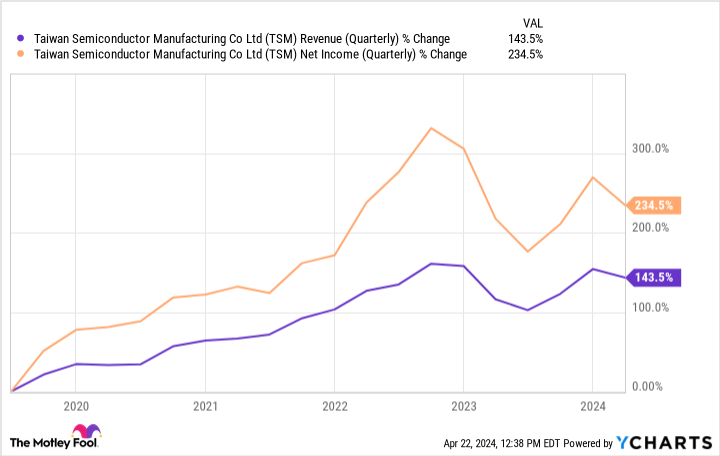

TSMC's revenue in the first quarter of 2024 was just over $18.8 billion, but was met with mixed reactions. On the positive side, it was up 12.9% year over year (YOY); on the negative side, it was down 3.8% from the previous quarter. Net income followed a similar trend, up YOY but down from the previous quarter.

Despite the drops from the previous quarter, it's important to examine TSMC's revenue and net income progress, especially over the last five years.

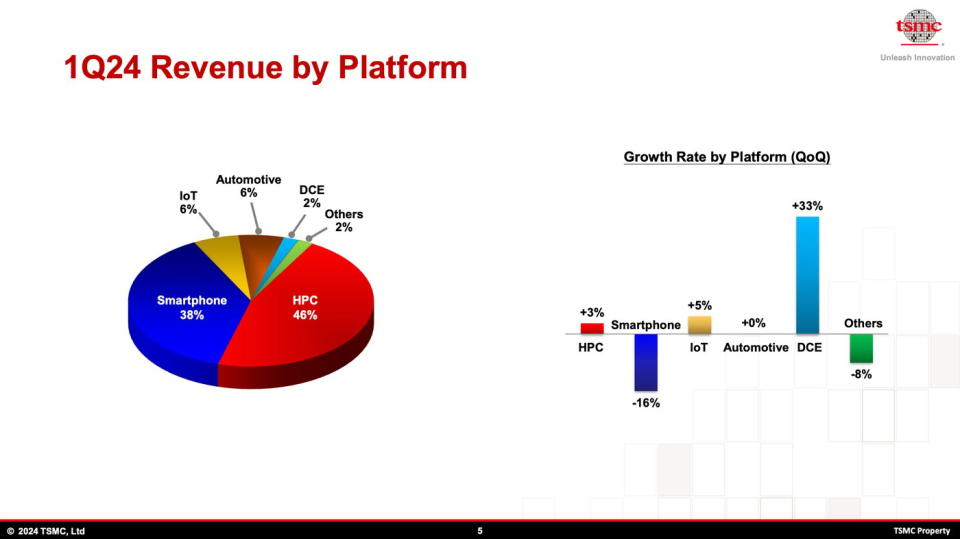

The quarter-to-quarter drop can be attributed to the seasonality of smartphone sales. Smartphone sales and production ramp up in the fourth quarter because many people purchase them for the holidays, so it's no shock that Q1 is slowing down from Q4.

The bigger focus should be on the longer-term growth of those two key financial metrics.

Investors should weather the smartphone sales slump storm

When TSMC announced its Q1 earnings, investors didn't seem too pleased, and the stock dropped 3% in a day. The displeasure didn't stem from its revenue and net income growth (or decline if you're looking quarter to quarter), but more from the outlook of smartphone sales.

Smartphone sales accounted for 38% of TSMC's revenue in the first quarter, compared to 43% in the previous quarter. This drop reflects the seasonality of smartphone sales and the overall slump being experienced industrywide. Smartphone sales have been down for a while, and on its recent earnings call, TSMC's CEO noted the recovery will likely continue to be gradual.

TSMC's growth will rely heavily on smartphone sales returning to more stable levels because they account for a significant portion of its revenue, but this doesn't strike me as a long-term problem that changes TSMC's value proposition. If anything, the news about smartphones caused investors to overreact and overshadowed the growth of other areas of TSMC's business.

TSMC's place in the tech ecosystem gives it longevity

Regardless of how investors feel about the current state of TSMC's business, there's no denying how important it is to the entire tech ecosystem. Without TSMC and its advanced chips, there's a strong case that plenty of tech companies and their electronics wouldn't perform at their current levels.

What sets TSMC apart from other chipmakers is the end stages of chip production and a process called "packaging," which involves enclosing the chip and putting in electrical connections critical for the chip's ability to function in different electronics.

All chip makers use the packaging process, but TSMC has a long list of patents (around 3,000) protecting its advanced chip-packaging technology. This technology allows TSMC to essentially stack and combine several chip components into a single item, leading to much higher performance than other chips. This creates a competitive moat that other chipmakers likely won't breach at any time in the foreseeable future.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $506,291!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 22, 2024

Stefon Walters has positions in Apple. The Motley Fool has positions in and recommends Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

1 Monster Stock Opportunity In the Global Chip Shortage was originally published by The Motley Fool